There’s a funny quote from Cal Ripken Jr., the Iron Man of baseball: “A lot of people say stubbornness is a bad thing, but it’s served me well.”

When it comes to your money – and your life – you need to be stubborn about certain things. That’s why I developed the Stubborn Money concept, which outlines the foundational things that you need to stubbornly protect: essential cash flow, saving, investing and legacy.

You have to be disciplined about saving and your approach to your finances because if you aren’t, you won’t end up where you want to be.

Be Stubborn About Planning and Protecting Your Income

When you’re early in your career, hopefully, your goal is saving and growing your wealth. In other words, you’re saving more than you are spending.

We can’t spend erratically over the course of our lives, because we have a relatively short income period. Our core earning years are ages 35 to 55.

If you’re planning to continue to spend the same amount over your entire lifetime, you need to save enough money during those high income-earning years to maintain that spending rate through retirement. This also means we must protect those earning years from risk.

This becomes a key reason why you need to be stubborn. Stubborn saving during these years is crucial to your retirement, your spouse’s retirement and your kids’ future.

Read more: Managing Your Wealth with Life Insurance through Life Stages

Be Stubborn About Protecting Your Goals

Most people don’t sit around and say, “I want to die with the highest possible net worth I can.”

Instead, goals you want to accomplish – like leaving money to kids or grandkids; funding 529s; or leaving money to charities, your alma mater and your church – drive your financial decisions.

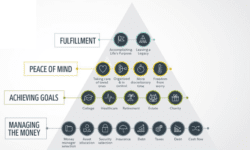

Fidelity has a concept they call the Client Value Ladder, which is similar to my Stubborn Money concept. The Client Value Ladder starts with a foundation of “managing the money,” which includes money manager selection, asset allocation, security selection, insurance, income generation, taxes, debt, and cash flow.

These are the base of the ladder that everything else – pursuing goals, financial confidence, fulfillment – is built on. When we don’t take care of things at the base, we risk everything above it. It’s just like building a house. If you don’t have a good foundation, you create risk to the rest of the structure.

Similarly, if these foundational items are not taken care of, you introduce risk to the rest of your life. For example, if you die as the primary income earner, could your spouse afford to send the kids to college or retire? If you have the wrong insurance, might you neglect your healthcare?

Proper planning lays out the bricks on which you build your legacy and work toward your life’s purpose and goals. And to get there, you have to be stubborn about taking care of the elements upon which everything else is built.

A financial advisor can help you build a strong foundation as you work toward your financial goals. Click here to schedule a complimentary strategy session.